Asset Distribution

A trust allows you to be very specific about how, when and to whom your assets are distributed.

A TRUST is a legal relationship created (in lifetime, or on death) by a SETTLOR when assets are placed under the control of a TRUSTEE for the benefit of a BENEFICIARY, or for a specified purpose.

Learn more

The Oxford English Dictionary (OED) is widely regarded as the accepted authority on the English language. The OED dates use of the word "TRUST" in a financial sense from 1825

A trust allows you to be very specific about how, when and to whom your assets are distributed.

There are dozens of special-use trusts that could be established to meet various estate planning goals, such as charitable giving, tax reduction, and more.

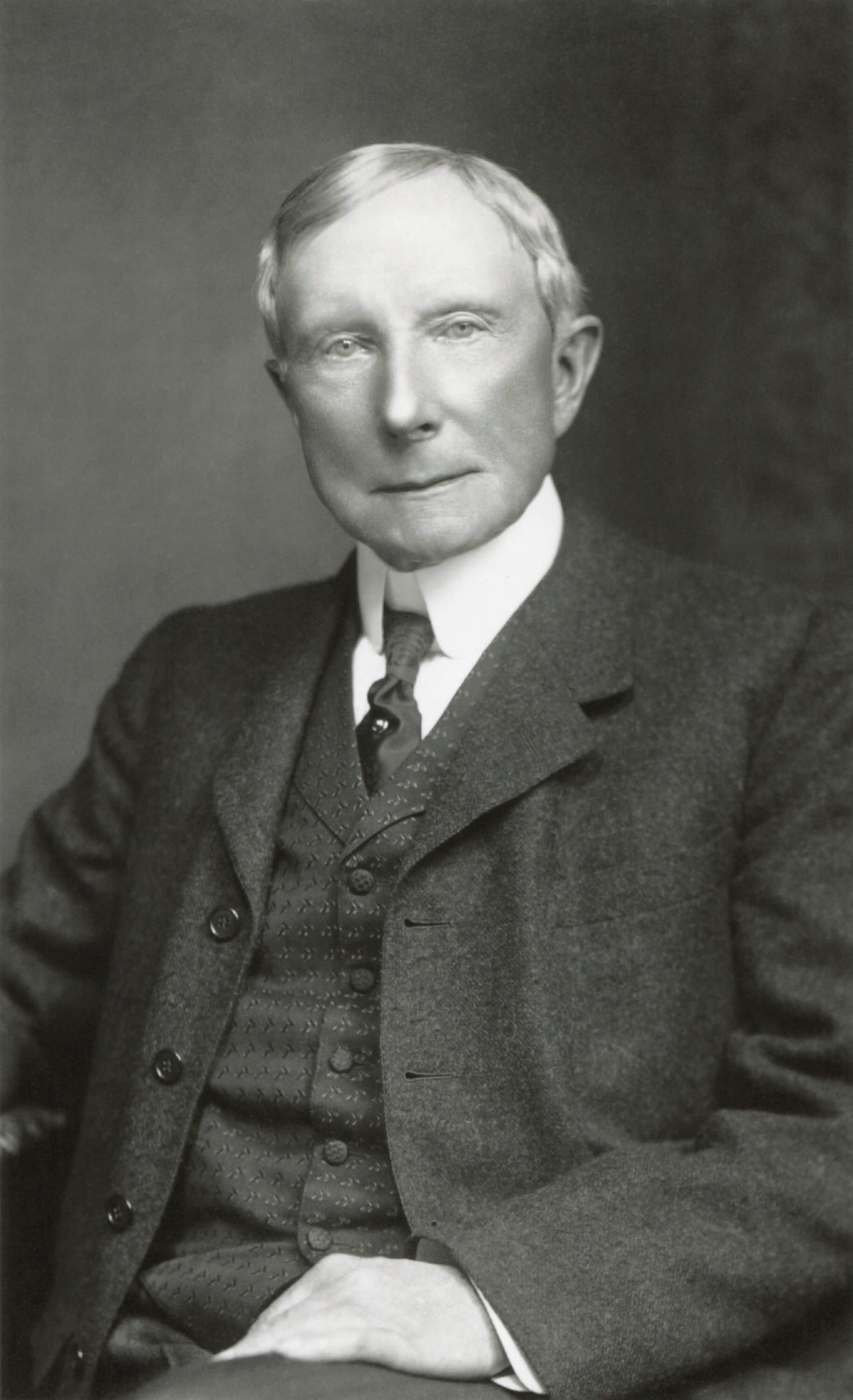

Here’s the high level of how the Rockefeller estate plan works:

The family forms a trust to hold their assets and document how they wish for their wealth to be passed on in each subsequent generation.

The trust owns and is the beneficiary of a life insurance policy on each of the family members. When each person passes, the proceeds of their policies are payable to the trust. And so it goes from generation to generation. Over time, the trust is well-funded with these proceeds and can afford the premium payments on each new family member.

Regardless of the trust instrument used, families that implement this structure are not trying to leave a huge pile of money for reckless spending. Instead, this strategy requires careful planning to create incentives for how recipients of trust dividends should arrange their affairs.

Building a Legacy that Lasts Six Generations…The Rockefeller plan is just one example of how to arrange your affairs for longevity. The problem is that most people do not want to think about death or make proper provisions for it.The Rockefellers , Kennedys, Marriotts, and Hiltons are old money families that you can learn from.